Visitors intending to reach the official website should visit kaa.go.ke

Jomo Kenyatta International Airport (JKIA) is the central hub for air cargo traffic in Kenya and one of the most significant players in Africa’s air freight industry. Kenya’s air cargo sector, particularly at JKIA, is largely focused on the export of perishable goods, a category that makes up the vast majority of cargo traffic in terms of weight. Below is an expert overview of the air cargo landscape at JKIA, including key exports, major operators, and the airport’s strategic position in global trade.

1. Dominance of Perishable Exports

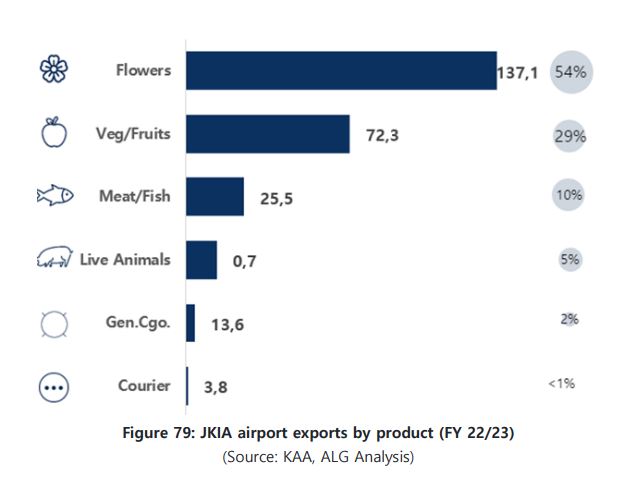

Kenya’s agriculture and horticulture industries play a vital role in the country’s air cargo traffic. The primary goods exported from JKIA are perishable items, including:

- Flowers: The largest export category, accounting for 54% of JKIA’s air cargo, with 137.1 kilotons (kTn) of flowers exported in the 2022/2023 fiscal year. Kenya is one of the world’s top exporters of cut flowers, and JKIA serves as a crucial link between Kenyan flower farms and global markets, particularly in Europe.

- Fruits and Vegetables: This category constitutes 29% of JKIA’s cargo exports, with 72.3 kTn being exported. These perishable goods, much like flowers, require fast and efficient transportation to preserve freshness and quality, underscoring the critical role of air cargo in this sector.

- Meat and Fish: Contributing 10% of the total exports, with 25.5 kTn transported annually. The export of meat and fish products is growing steadily, adding another significant dimension to JKIA’s perishable goods exports.

- Live Animals: Though a much smaller segment, live animals make up about 5% of air cargo exports at 0.7 kTn, requiring specialized handling facilities.

Together, flowers, fruits, and vegetables make up 83% of the total air cargo volume at JKIA, reflecting Kenya’s agricultural export strength. The airport’s ability to handle these temperature-sensitive goods efficiently is crucial for the country’s economy.

2. Strategic Position in Global Trade

JKIA’s strong focus on perishable exports positions it as a key player in global agricultural trade, particularly in the European market, where demand for fresh Kenyan produce and flowers is high. The airport’s proximity to horticultural production zones in Kenya allows it to efficiently facilitate the transport of these goods, offering fast transit times that are vital for maintaining product quality.

Kenya’s position as a world leader in cut flower exports continues to solidify, with JKIA playing an essential role in connecting producers with international buyers. The airport’s ability to handle growing cargo volumes will be key to maintaining and expanding this market position in the coming years.

3. Major Cargo Operators at JKIA

Several air cargo operators play a critical role in JKIA’s operations, including both domestic and international carriers:

- Kenya Airways Cargo: The national carrier is a significant player in air freight, handling a substantial portion of the country’s perishable goods exports.

- Astral Aviation: A Kenyan all-cargo airline, Astral Aviation operates across Africa and beyond, serving as a key player in regional cargo transport and export.

- International Carriers: Several major global cargo operators, including Air France/KLM, Lufthansa Cargo, and Emirates SkyCargo, operate flights out of JKIA. These airlines provide connectivity to global markets, particularly in Europe and the Middle East, ensuring that Kenyan exports reach their destinations quickly.

- Cargo Terminals: Various cargo terminals handle air freight at JKIA, with AFS, Kenya Airways, and Signor’s managing more than 70% of the total cargo traffic at the airport. These terminals provide essential services, including storage, handling, and customs clearance for perishable goods.

Here are the key insights:

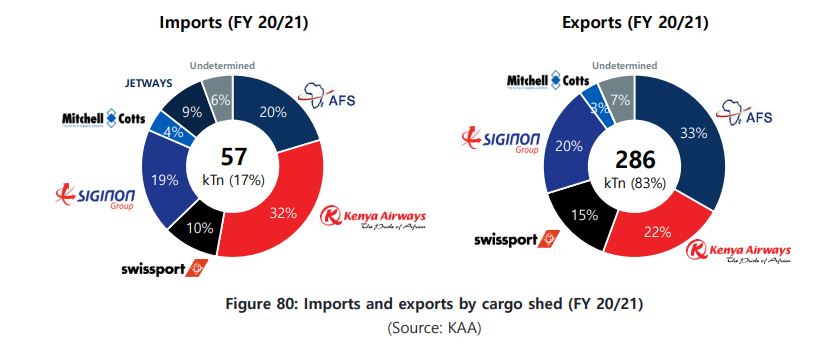

- Imports (FY 20/21):

- Total imports handled at JKIA amounted to 57 kilotons (kTn), which represents 17% of the total cargo.

- The largest share of imports was handled by Kenya Airways Cargo, accounting for 32% of the total import volume.

- AFS managed 20% of the import traffic, followed by Signon Group at 19% and Swissport at 9%.

- Smaller players include Mitchell Cotts (4%), Jetways (3%), and an undetermined share at 6%.

- Exports (FY 20/21):

- Exports accounted for a significant portion of JKIA’s cargo, with 286 kilotons (kTn) handled, representing 83% of the total cargo.

- AFS dominated the export market with 33% of the total export volume.

- Kenya Airways Cargo followed with 22%, while Signon Group managed 20% of the export cargo.

- Swissport handled 15% of exports, and Mitchell Cotts accounted for 3%, with an undetermined portion at 7%.

These figures illustrate JKIA’s significant role in Kenya’s air cargo operations, with a strong focus on exports, primarily driven by local and international cargo operators.

4. Potential for Future Growth

The ALG report projects that cargo volumes at JKIA will continue to grow, particularly in the export of perishable goods. With cargo volumes expected to double by 2055, reaching over 740 kTn, the airport must invest in expanding and modernizing its cargo infrastructure.

Kenya’s strategic location in East Africa positions it as a key gateway for trade with Europe, the Middle East, and Asia. As global demand for Kenyan agricultural products continues to rise, JKIA’s role as a cargo hub will become even more critical, driving the need for further development of its cargo terminals and handling facilities.

5. Challenges and Opportunities

While JKIA is well-positioned to remain a leader in cargo traffic, there are several challenges and opportunities to consider:

- Infrastructure limitations: As cargo volumes grow, existing facilities may struggle to keep up with demand, leading to delays or inefficiencies. Investments in new cargo handling systems and expanded terminal capacity are crucial to maintaining competitive advantage.

- Cold chain logistics: Given the high volume of perishable goods, the need for robust cold chain logistics is essential to ensure products reach global markets in optimal condition. Continued improvements in this area will help Kenya solidify its position in the global supply chain for perishable exports.

- E-commerce potential: The growth of e-commerce in Africa offers additional opportunities for air cargo. JKIA, already a major cargo hub, could expand its role by becoming a key logistics center for e-commerce shipments, both for local and international markets.

Conclusion

Jomo Kenyatta International Airport plays a pivotal role in Kenya’s agricultural export economy, with the majority of its cargo traffic consisting of perishable goods like flowers, fruits, and vegetables. As the largest sub-Saharan cargo hub, JKIA’s ability to handle growing volumes of exports is essential for maintaining Kenya’s position in global markets. With cargo volumes expected to double by 2055, continued investments in infrastructure, cold chain logistics, and handling capacity are critical to ensuring that JKIA remains a leading cargo airport in Africa and the world.